Even though ADP earlier in the week came in on the money, that is, 179K versus forecast of 171K, there was still an off chance that NFP today could come in stronger than forecast. Then again, it’s the summer and usually there are more job creations during this period.

I decided to put my straddle trade on the EURUSD and USDJPY at about 8:26pm with the following details: –

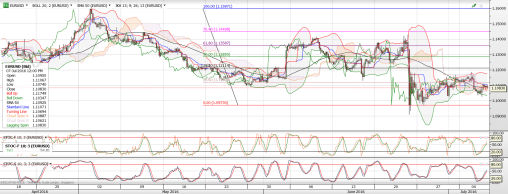

EURUSD – Stop if Offered at 1.1108, Spot at 1.1138, Stop if Bid at 1.1168 and corresponding SLs at 30bps out.

USDJPY – Stop if Offered at 100.80, Spot at 101.18, Stop if Bid at 101.48 and corresponding SLs at 30bps out.

As it turned out, NFP came in very strong at 255K versus expectations of 180K.

Both my trades was triggered.

I squared the EURUSD at 1.1048 for a trading profit of 60bps.

I squared the USDJPY at 101.82 for a trading profit of 0.34.

A pretty good end to the first week of trading in August.

It’s TGIF and I am going to shut down my computer and go meet some friends for drinks!!!

Here’s wishing one and all a great weekend.