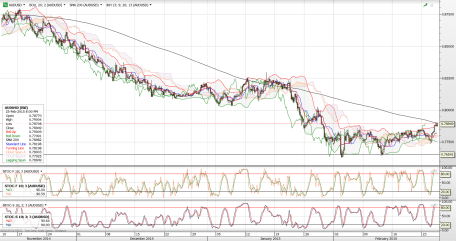

The outstanding Greece issue, collapse of commodity prices and the collapse of the Shanghai and Shenzhen equity markets was all the right ingredients to push the AUDUSD below 0.7500, then, 0.7400.

RBA Stevens also reiterated in his statement while holding rates at 2% that further weakness in the AUD is expected and necessary because of weak commodity prices.

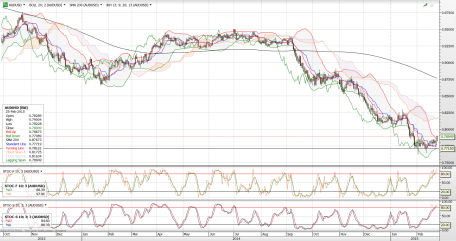

I have a different opinion and believe that the AUDUSD should be trading at a fair value of about 0.7700. Australia is not all about commodities, it has a strong agriculture based export industry, including dairy and other foodstuff. Health products and pharmaceuticals are also significant. Property market be it supported by Locals or foreigners is buoyant because of cheap mortgage rates.

I see AUDUSD spiking to 0.800 and then coming back down to the 0.7700 range within the next the next 3 months and our option is good for 4 months till end November.

Since the start of 2015, AUDUSD started out the year at about 0.7720 and hit a low of 0.7566 in March/April. A strong pike to 0.80 happened in late April and a new high for the year at 0.8115 in mid May. All fundamentals in Australia has been the same for the past 6 months, so will we see the pattern repeat itself? I believe so.

Spot: 0.7390

Strike: ATM spot

Premium: 200bps

Breakeven: 0.7590

Expiry: 27 November 2015