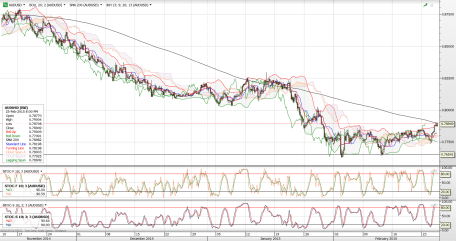

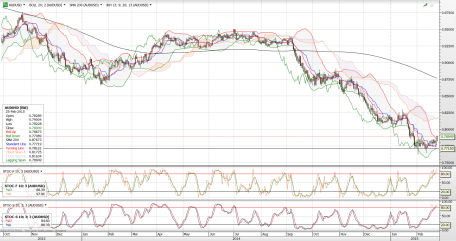

On 6 Jan, my ichimoku and stochastics looked ripe to go long on the AUDUSD and I executed a call option expiring Friday, 16 Jan; strike at 0.8118, premium at 57bps and breakeven at 0.8185.

The following few day, the AUDUSD actually went down to 0.8030 and I thought………..Oh dear my decision was wrong, however, I believe strongly that with the turmoil in Euroland and uncertain disinflation in the UK and hard to believe recovery in the US and crumbling oil prices………….surely everyone would go to the safe haven AUD currency.

Well, the AUDUSD certainly kept me nervous, yesterday it went to a high of 0.8240 before slipping down to 0.8160 on fears of poor employment numbers.

Guess what? Today, the employment numbers came in very strong at 37,400 jobs versus forecast of 5,300 jobs. It kept AUD bidded the whole day and then by London open it lost steam again falling back to 0.8165.

Then the SNB announced that they are removing the cap of 1.20 on the EURUSD…………….game over! AUDUSD shot up to 0.8294, GBPUSD shot up to 1.5266 and USDJPY shot up to 116.25…………..everyone was selling the EURUSD and it crashed down below 1.17 very quickly!

I am getting too old for this rollercoaster ride, then again, it’s fun.

This is my first trade for 2015 and many more to come, so stay tune…………..

By the way, I will be rounding up a performance report for 2014, though I am sure all of you have experienced it yourselves last year; the first half was sleepingly boring and then the second half of the year was ‘rock and roll’. Nonetheless, because of the difficulty in calling the trades and reading the market, our overall absolute performance for 2014 was much lower than in 2013. Anyway, will share more information on the numbers shortly.

More importantly, will be writing an article my thoughts for 2015!