Market was anticipating the much awaited non farm payroll numbers and the unemployment numbers to confirm that the U.S., is on track in its economic growth recovery.

Wednesday’s ADP number was not encouraging at 213K against forecast of 224k, however, it was mitigated by the upward revision of December’s number from 241K to 253K. This means that there is a possibility that the non farm payroll numbers could surprise on the upside of forecast.

Market was steady at about 9:10pm Singapore time. My hunch told me that the non farm payroll numbers would be better, so I decided to bet on my hunch.

Orders: –

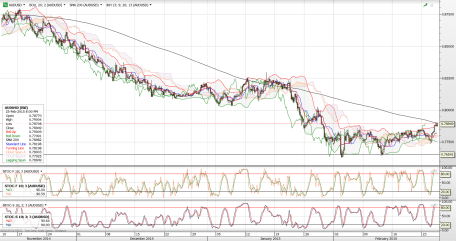

1. GBPUSD – Stop if Offered at 1.5290 when spot was at 1.5323

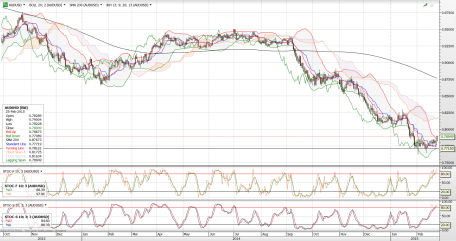

2. EURUSD – Stop if Bid at 1.1500 when spot was at 1.1486

3. EURUSD – Bought a put option expiring Monday, February 9 with a premium of 36bps, spot at 1.1486 an breakeven at 1.1450

4. USDJPY – Stop if Bid at 117.60 when spot was at 117.28

Of course, all of us knew what happened, the non farm payroll numbers came out at 257K busting forecast of 236K and the highest in the past 6 years.

Market sold off the GBP, EUR and the JPY in a BIG way!

At about 11:15pm, I decided to square off all the trades.

Squared off the GBPUSD at 1.5248 for a trading profit of 42bps.

Squared off the USDJPY at 118.88 for a trading profit of 128bps.

EURUSD stop if bid order was not triggered.

Sold off the put option at 1.1326 for a trading profit of 124bps.

In absolute terms, we made 294bps in totality for all 3 trades.

WHAT A NIGHT! THANK YOU UNITED STATES OF AMERICA!