The FX markets has proven to be most unpredictable. On the March 22nd, I felt strongly that the USD was oversold and the charts seem to indicate it, however, after Yellen’s speech at the NY Economic Club, the USD was killed.

All the majors rallied against the USD and in fact, made new highs for 2016. This was more disheartening, however, I was fortunate in that I played the potential opportunity while waiting for the market to come to me by way of options. Therefore, I have accepted my absolute losses which was the premiums I paid for the options upfront.

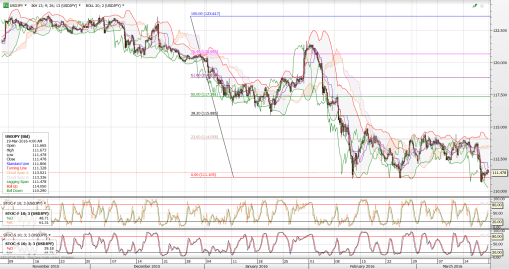

I have been hearing from the banks and on the ground that many FX clients have been caught on the wrong foot. Worse still though the USD has made back some gains, the JPY went against the rest of the majors by strengthening against the USD. Can you imagine that the JPY has moved 5 big figures since the last week of March?!

Anyway, when I started seeing the USD gain back ground against the majors I decided to sell of two of my outstanding options; the GBPUSD Put Option and the AUDUSD Call Option.

On April 6th after London opened, the GBP was aggressive sold off, I decided not to wait again like I did two weeks and so decided to sell the put option at 1.4030 for a trading profit of 252bps (breakeven was 1.4282), option originally expiring on April 29th.

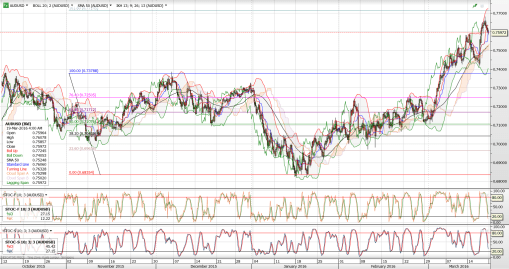

On March 31st after NY opened, the AUD continued climbing up against the USD, I put in an order to sell the call option at 0.7700 and it got triggered, locking in a trading profit of 280bps, call option had an expiry date of July 9th.

While the trades turned out in my favor it was not without days and weeks of disbelief that my call was potentially wrong, but instead of waiting closer to expiry, I decided not to star a gift horse n the face, so take profit on the options.

As you can see, the risk reward ratio wasn’t great, on average about 1:1. A better trade would be 2:1 or higher. Anyway, I am just glad to be out.

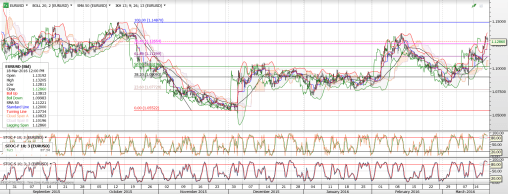

Now I still have three outstanding put options; EURUSD, USDJPY and AUDUSD which are not in the money and we are going into the second week of April. I have some time left and let’s hope the market moves in my favor.