This is what I usually try to avoid; a FOMC meeting where only a statement is published and no press conference.

Then, the whole world begins dissecting the statements and using different words to support their views, this usually causes big whipsaws as we just saw a few minutes ago.

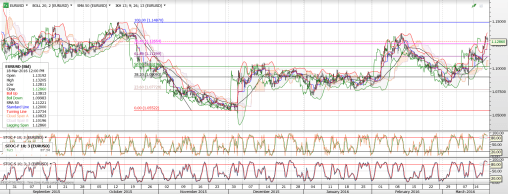

Just before the release of the statement, EURUSD was holding at 1.1332, when the statement was published, it fell to 1.1275 as the reference to global risks was taken out which implied that the Fed will just focus on the US and not use the rest of the world as an excuse for not raising rates.

Then, the market zeroed in on the word, ‘stance’ of the monetary policy to mean an accommodating stance, EURUSD reversed and shot back up to 1.1333.

Anyway, I put in a small OTM order betting the downside with the following details: –

EURUSD – Stop if Offered at 1.1300, Spot 1.1332, SL 1.1330

As it turned out the first move was down and it triggered my trade, I quickly decided to square off the trade at 1.1275 when I was speed reading through the statement and felt that the statement was quite balanced.

Gripping and stressful trade, and only rewarded with trading profits of 25bps.

Looks like June will be the D-Day!

Goodnight everyone.